How Healthcare Funding in the Philippines Impacts Patient Care — July 08 2025

Explore how healthcare funding in the Philippines improves patient care through better access, upgraded facilities, and stronger medical staff support.

Buy Now, Pay later has been making headlines in the fintech space for the last couple of months with the growing relevance of providers like Affirm, Afterpay and Klarna.

Today the buying and selling activity is completely digital, and platforms like online marketplaces, digital/mobile wallets are getting increasingly popular with the pandemic driving these tech-enabled platforms towards mass adoption. This trend is likely to continue as the economy readjusts in the post pandemic era, bringing about a change in the consumer’s buying behavior. The global population has increasingly been confined in closed quarters for a prolonged period of time, the purchasing behavior is completely shifting from the basic physiological or social needs, to buying items that fulfill their ideas of self-fulfillment, and psychological needs. More and more people are now looking at different ways they can buy what they want without incurring more debt.

BNPL is the perfect solution and hugely popular among the Gen-Z, millennials, and catching the fancies of even the baby boomers. Some promising development have been made in this segment in the recent times which are —

· Amazon partnering up with Affirm

· Apple pay has announced a BNPL offering to make interest-free purchases using any credit card with plans that can help the buyers avoid any late or processing fees.

· Paypal will no longer be charging any late fees on BNPL payments

· The acquisition of AfterPay by Square

In this article, we will take a close look at the growing popularity of Buy Now, Pay Later and examine different factors driving growth in this latest revolution of the Fintech industry.

With Affirm onboard as their BNPL partners, select Amazon customers will have the option to split payment for a minimum purchase of $50 by using the platform, marking Amazon’s first partnership with an installment provider.

With Apple’s planned BNPL partnership with Goldman Sachs, and Square’s intention to acquire Afterpay for US$29B, it may not be too far-fetched to think that the BNPL space is going to be the next battleground among BigTechs.

Buy Now Pay Later or BNPL is growing in popularity among consumers globally as it gives them the flexibility of deferred payments in installment basis for online purchases. This is happening at the back of a global eCommerce boom as more and more businesses transition to online as a way to reach the huge and savvy Gen Z and millennial consumer segments. In addition, this digital adoption is further accelerated by the COVID-19 pandemic.

But BNPL is nothing new. Several of the largest players in the space started offering split payments for consumer purchases years ago, with providers like Sweden-based Klarna in 2005, US-based Affirm in 2012, and Australia-based Afterpay in 2014.

With major activities happening in the space, including Zip’s acquisition of QuadPay in September 2020 and Affirm’s IPO in the US in January 2021, “buy now, pay later” is now on the spotlight. But what is it and what makes it different from your usual credit card or other financing alternatives?

Convenience and flexibility for consumers. Flexibility — Consumers benefit from these services by making purchases that are otherwise expensive more affordable at present by splitting the amount into smaller payments over time.

Convenience — There is the convenience factor that younger consumers in an increasingly digital world require nowadays. With easy access at checkout, faster approval, and streamlined overall experience, it becomes increasingly appealing to the vast digital consumer base.

While for merchants, BNPL’s value proposition is in boosting sales conversion and average order value. By providing payment flexibility, BNPL can help consumers purchase items that are otherwise unaffordable and thus increase sales conversion for the merchant.

These value propositions have led to increasing adoption from both consumers and merchants.

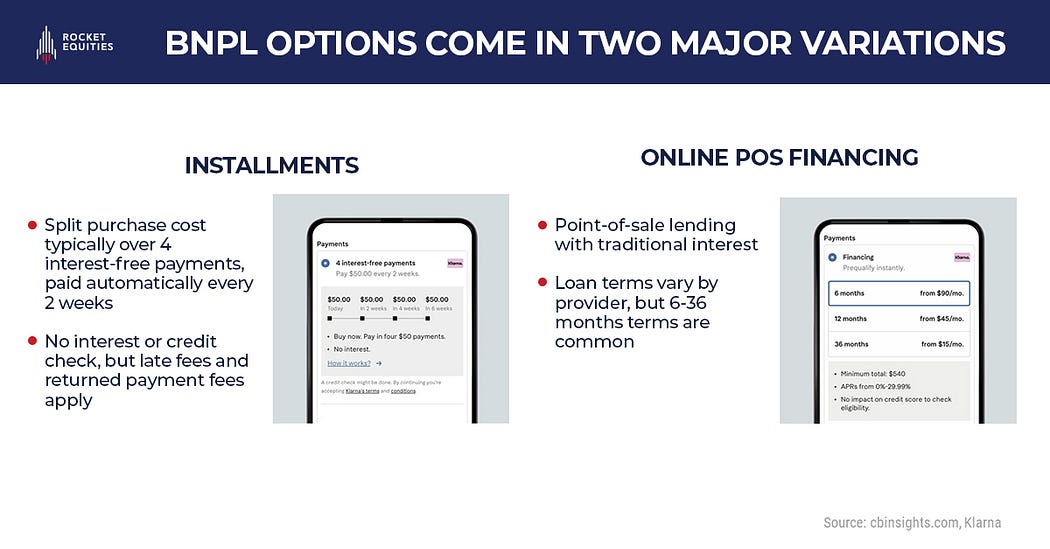

While exact product features vary by BNPL provider, there are two main categories in the market today.

Installments (Split Pay) — option to split the purchase cost into multiple payments on set schedule, typically over 4 payments every 2 weeks. This option usually carries no interest or credit check, but late fees may apply.

Online POS (Longer Term) Financing — option to pay for the purchase cost, such as big-ticket items, on a longer term ranging from 6–36 months.

According to Kaleido Intelligence, BNPL posted significant growth in recent years, with transaction value having grown by 292% between 2018 and 2020. The USA is still the leading market in terms of transaction value in 2020, with Germany, Australia, Sweden, and UK rounding out the top five.

According to CB Insights, BNPL today reflects a small portion of the overall spending on payment cards (including credit, debit, and prepaid cards), which in the US is already generating annual spend volume of roughly US$8T. However, it is believed that the BNPL industry is at an inflection point and according to some estimates, the global BNPL industry will grow 10–15x its current volume, topping US$1T in annual gross merchandise volume by 2025. This has led some incumbents to take a closer look at this space.

It is clear that e-commerce sites are the main distribution channel for the BNPL business model, so providers are racing to capture market share by entering into partnerships with major e-commerce players, key merchants, and even platforms that serve these merchants, such as Shopify.

With ever growing interest from consumers, merchants, and investors, it can be said that the BNPL space is just starting to expand and that it is still too early to determine who’s going to be the undisputed number 1. But the number of key merchant partnerships and amount of gross merchandise value may be good indicators of whether a BNPL provider is on the right track.

Rocket Equities is a Southeast Asia-focused financial advisory firm experienced in capital raising, M&A, and buy-outs.

Rocket Equities works with market leaders in tech and tech-enabled companies to raise capital in debt & equity markets, acquire competitors locally and regionally, and create an exit for founders by leveraging its network of 300+ professional investors composed of VCs, PEs, Corporates, and CVCs in APAC.

Latest fundraising news on E-commerce from Rocket Equities — PH start-up Great Deals E-commerce Corp raises $30 million Series B from CVC, Fast Group and Navegar

References:

https://www.cbinsights.com/research/report/buy-now-pay-later-outlook/

https://fincog.nl/blog/28/the-global-phenomenon-of-buy-now-pay-later

https://1982.vc/news/buy-now-pay-later-for-impact-in-southeast-asia/