How Healthcare Funding in the Philippines Impacts Patient Care — July 08 2025

Explore how healthcare funding in the Philippines improves patient care through better access, upgraded facilities, and stronger medical staff support.

Logistics for the e-commerce industry comes with a host of new challenges as many brands attempt to entice their customers with high discounts, reduced delivery charges, next-day delivery (or quicker delivery), and easy returns. In order to gain a competitive edge and build a sustainable business model, these brands need a strong strategy to master their logistics and transport processes at an optimized cost to remain profitable.

Technology plays an integral role in helping these companies maneuver their trade routes and provide good customer service. IoT (Internet of Things) helps in creating a connected ecosystem, where all players can interact, share and access vital information with each other.

Speed of execution is another key element for the brands because the financial stakes related to these merchandises are important.

There are few factors that are crucial to ensure smooth logistical operations in any setup, let alone a complex landscape like the e-commerce industry. Effective communication systems, real-time tracking of packages/vehicles, continuous monitoring across the supply chain, and safely delivering the packages to the end-customer are all services enabled by IoT in e-logistics.

IoT helps brands with inventory tracking software, location and route management, information about the available space and inventory management for warehousing, documentation for cross-border operations, and implementation of AI with autonomous (self-driving}ss delivery vehicles, and drone technology.

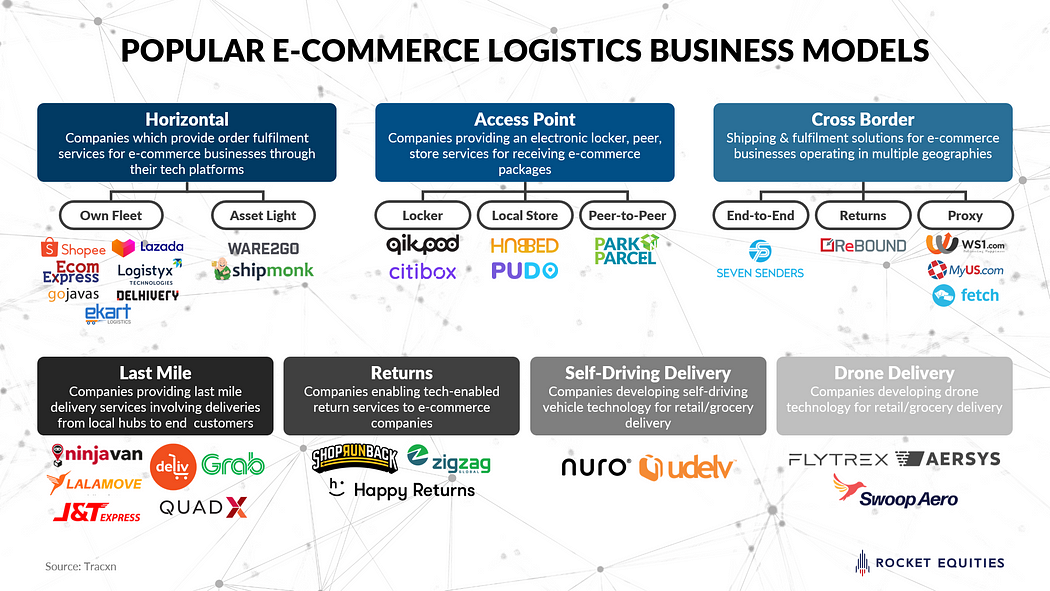

Let’s take a look at different e-logistics business models-

Horizontal: Companies that provide order fulfillment services for e-commerce businesses through their tech platforms.

Cross Border: Shipping and fulfillment solutions for e-commerce businesses operating in multiple geographies.

Last Mile: Companies that provide last-mile delivery services which involve deliveries from the local hubs to end customers.

Access Point: Companies providing an electronic locker, peer, store services for receiving e-commerce packages.

Returns: Companies enabling tech-enabled return services to e-commerce companies

Self-Driving Delivery Vehicles: Companies developing self-driving vehicle technology for retail/grocery delivery

Drone Delivery: Companies developing drone technology for retail/grocery delivery.

Horizontal (own fleet and asset-light), Last Mile Logistics, and Cross border companies are usually attached with major e-commerce brands and have the process flows specially designed or customized to cater to any special needs for their partner brands. While the horizontal logistics model is the most popular, the last mile companies have gained instant popularity during the pandemic, and cross-border logistics firms have seen a rise in consumer demand as their interests shift towards high-value or luxury items.

Access points comprise companies that provide the services of receiving e-commerce packages with locker services, from peer-to-peer or through local stores.

Reverse logistics or package returns are perhaps the trickiest of all among the logistics business model. While conventional logistics enable the product to reach the end customer, reverse logistics has to retrace its steps in the value chain. According to Statista, return deliveries cost a whopping 642bn USD globally, out of which 363bn USD are from North America alone.

Some of the other segments that have been driving the investors’ interest in the logistics industry are Self-driving delivery vehicles & drone delivery.

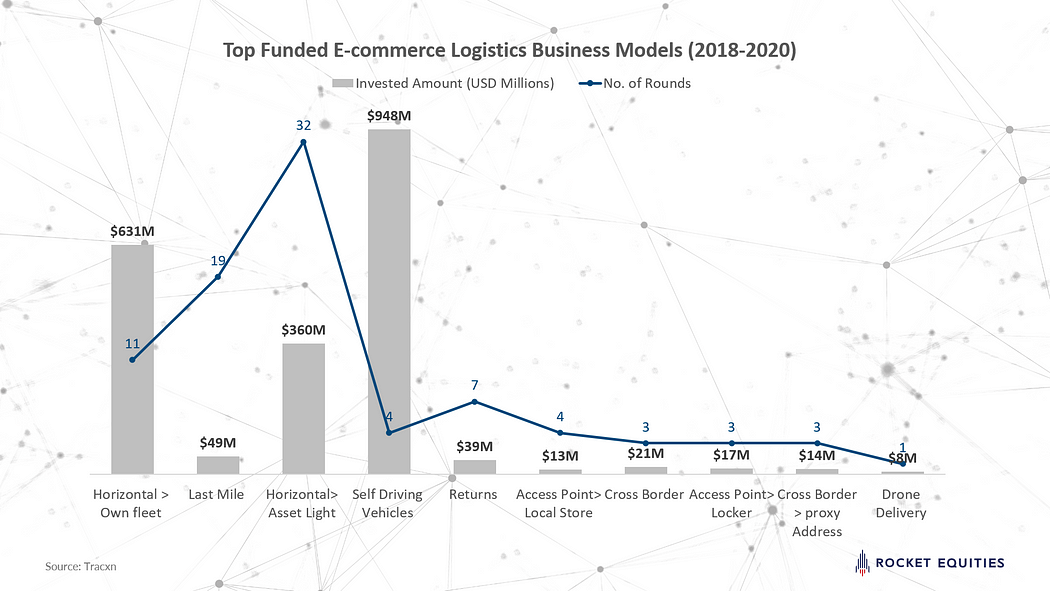

This figure sums up the investment activity in the e-logistics landscape from 2018 to 2020. Horizontal segments have received the highest funding through these years and Last Mile logistics has seen the most number of investment rounds among the traditional e-logistics business models.

Self-driving delivery vehicles, also known as autonomous delivery vehicles, have shown remarkable promise by raising 948Mn USD in only four investment rounds.

Founded in 2016, California-based Nuro.ai has raised a total of 1Bn USD with SoftBank Vision Fund, Greylock Partners, and Banyan Capital Partners as lead investors. Brands like Domino’s, Kroger, Walmart, Chipotle, and CVS pharmacy have been the early adopters in making use of this delivery service.

Some other notable companies in this segment include Boxbot, from San Francisco that provide robotic solutions for last-mile deliveries, and Udelv, another California-based company that designs custom-made autonomous delivery vehicles. Established in 2012, German company TeleRetail has also been active by automating local logistics and transport services.

Access Point is another emerging segment for e-commerce package delivery and easy returns. Access points range from digital lockers or convenient local stores that serve as a replacement delivery address when consumers are not at home to receive a package or to help manage their package returns.

Digital locker services like those of Qikpod or Smartbox allow e-retailers to drop off their packages in lockers which the consumers can later access by using their smartphones or through unique access codes.

Local store access points can include 24X7 local businesses, neighborhood convenience, and grocery stores. Hubbed, an Australian-owned company founded in 2014 provides a vast network of collection points and parcel management solutions for the e-commerce industry.

On-demand peer-to-peer logistics systems help in the movement and storage of goods that match independent supply resources. It helps businesses to seek out and engage for their logistical needs, these could be — warehouse space, truck space, or delivery services. They can make requests and engage in services on demand. On-demand P2P Logistics systems use internet-based platforms to provide wide-reach visibility into untapped resource capacity.

These solutions are geared towards managing residential package deliveries as well as enable small businesses to make use of the delivery network for their shipping needs. Safety, convenience, and reliability are some of the most important factors that are prompting consumers and businesses to make use of these services. Brands like Amazon, eBay, Flipkart, Alibaba.com, Shopify are some of the top e-commerce companies that actively engage with the access point delivery system.

With the onset of the pandemic, investors have been forced to give a second look at this segment. There have been multiple news reports about drones delivering food, groceries, packages, and even beer. Iceland, Israel, the United Kingdom, and the United States of America are some regions that are active in this segment. Flytrex, an Israel-based company founded in 2013 has raised a total of 10.5Mn USD but this segment is still in its nascent stage with regulations and obtaining necessary permissions being the major roadblock for this segment from getting popular.

The e-commerce industry has given the global logistics industry a second lease of life and technology has helped the creating an even playing field. While the e-commerce brands fight it out with reduced prices and discounted shipping charges, the logistics companies strive to create a cost-efficient supply chain network to remain relevant.

In the next article, we will explore the investment landscape of the e-logistics industry where we will take a deep dive into the investment activity, take a closer look at the emerging companies, and round up all the top investors in each segment of this evolving industry.

Rocket Equities, a corporate finance and M&A advisory firm for fast-growing mid-sized companies in Southeast Asia.

Latest fundraising news on logistics from Rocket Equities — QuadX to raise $ 25 million to ride the e-commerce boom