Buy Side vs. Sell Side M&A: Understanding the Differences — May 30 2025

Explore the key differences between buy-side and sell-side M&A, including their objectives and the roles of advisors, to support informed decision-making.

Southeast Asia is known as a late adopter of the latest trends in tech and finance. Most payment for online orders and deliveries still happens through cash, and most people in rural areas still have difficulties having access to mobile and internet connection. As such, the adoption of telemedicine and other healthtech was quite delayed.

In recent years internet connectivity and tech adoption have boosted in Southeast Asian countries, and consumers are now embracing the digital lifestyle. In a survey done by Bain & Company in 2019, before the height of the COVID pandemic, consumers were already expecting to use telemedicine, self-diagnosing apps, and health management tools in the next five years. The promise of easy and quick access to health services brought by these new healthtech products appeals to consumers who are already well adjusted to them anytime and anywhere on-demand digital lifestyle (e.g., delivery apps, e-commerce).

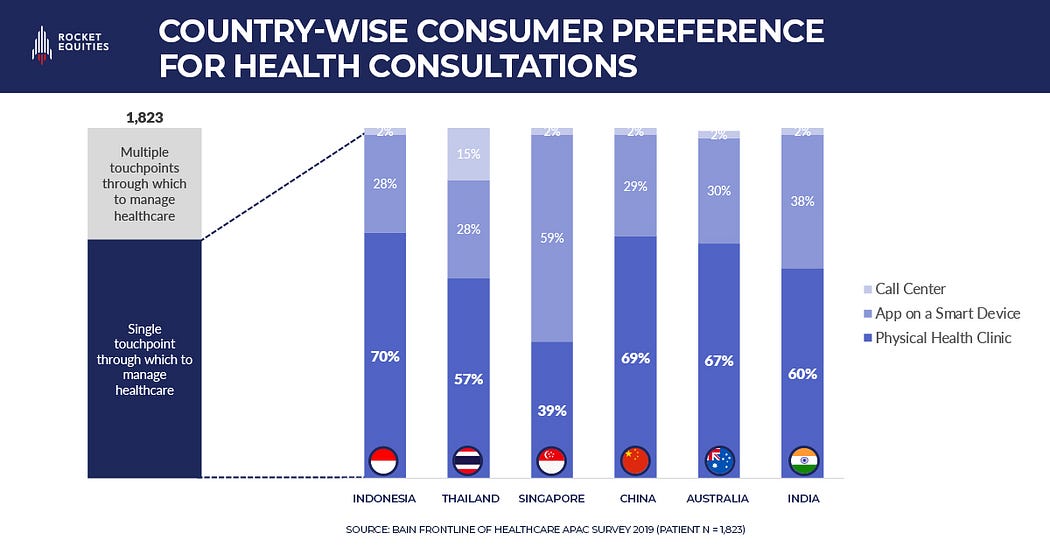

Despite strong support for online health consultations in the future, the majority of consumers (about 70% of survey respondents) still prefer face-to-face doctor visits, as shown in the figure below.

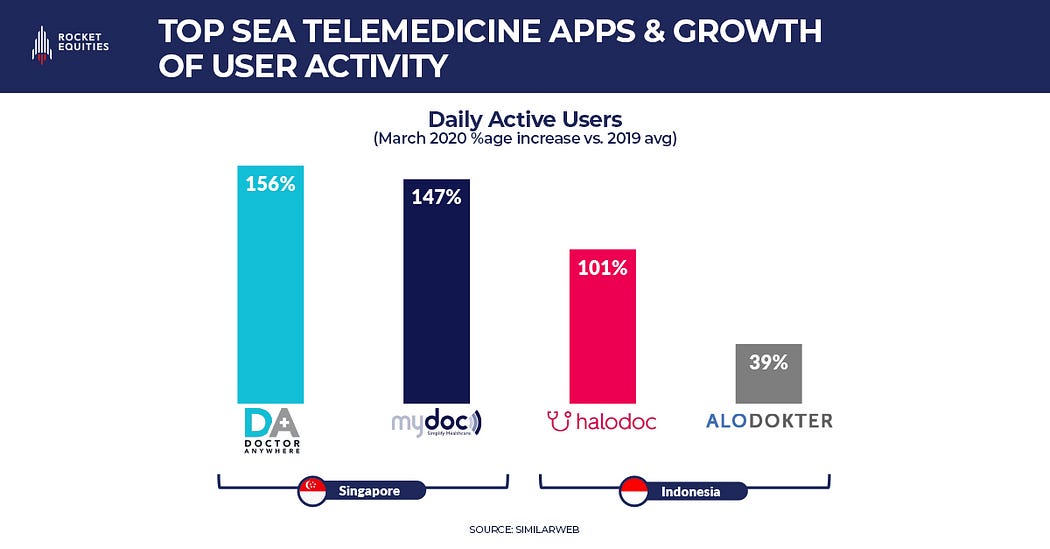

Moreover, all hesitancies in adopting digital health services faded when the COVID pandemic heightened. Southeast Asian governments imposing stringent lockdown restrictions and fear of face-to-face interactions forced patients to seek medical through online means. Popular telemedicine apps like Doctor Anywhere, MyDoc, Halodoc, and Aldokter all experienced a sharp increase in the number of active users.

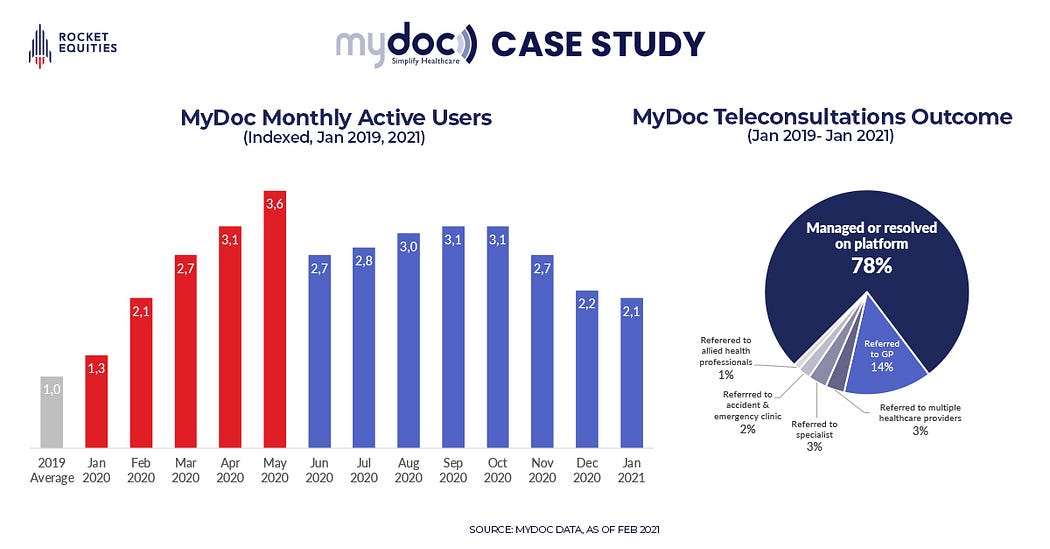

Looking closely at MyDoc numbers, a Singaporean telemedicine platform, its monthly active users grew 272% from January 2019 to January 2021. MyDoc lodged the highest number of users during May 2020, at the height of the pandemic in Singapore. During the last months of 2020 and the start of 2021, MyDoc was able to keep its active users at a level way higher than the 2019 average.

Telemedicine platforms quickly became the means for patients to seek medical services. Looking again at MyDoc’s statistics, almost 80% of its cases were resolved on its platform, and only a few needed to be seen by medical professionals physically.

We now see telemedicine apps as an efficient way of triaging patients seeking medical attention. Telemedicine or teleconsultation apps can effectively reduce patient wait times, lighten the load of overcrowded hospitals, and decrease healthcare costs (e.g. reduced fees and transportation costs going to clinics and hospitals).

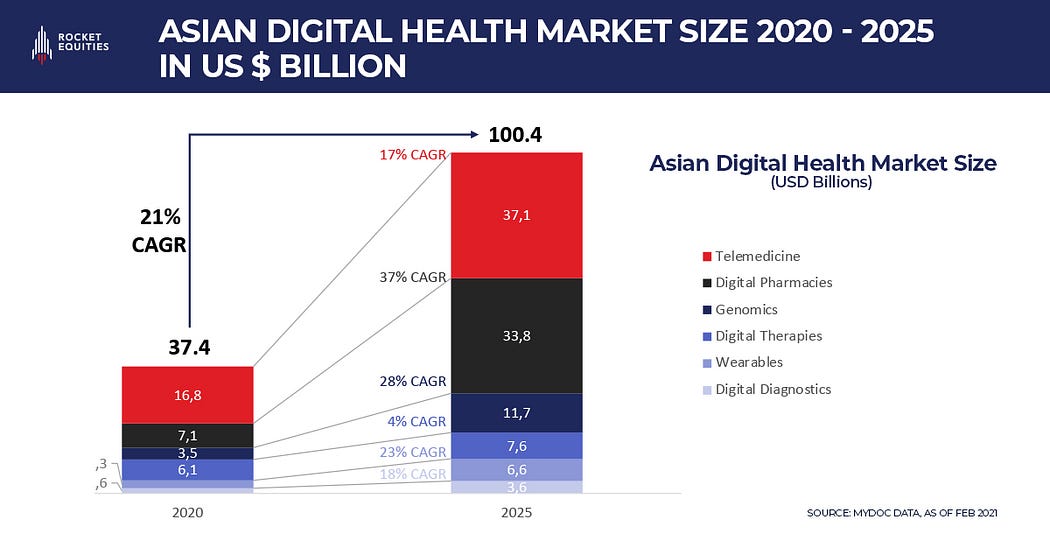

As Southeast Asian consumers have already experienced the convenience of telemedicine, it seems that these healthtech apps are here to stay for good. The pandemic accelerated the use of technology in the healthcare market, and that’s not just limited to teleconsulting services but also online pharmacies, wearable devices (e.g., smartwatches, insulin monitoring), and other health platforms. The digital health market in Asia is estimated to be valued at $100.4 billion by 2025, growing at 21% CAGR (2020–2025), and a third of this market comprises telemedicine players.

Rocket Equities is a Southeast Asia-focused financial advisory firm experienced in capital raising, M&A, and buy-outs.

Rocket Equities works with market leaders in tech and tech-enabled companies to raise capital in debt & equity markets, acquire competitors locally and regionally, and create an exit for founders by leveraging its network of 300+ professional investors composed of VCs, PEs, Corporates, and CVCs in APAC.

Latest fundraising news from Rocket Equities

E-commerce — Great Deals raises US$12M from Navegar to be the Alibaba of the Philippines.

Gaming & Esports — Philippines-founded esports startup Mineski Global nets $10.6 million Series A Funding