5 Types of Asset Management Services in the Philippines — May 08 2025

Discover asset management services in the Philippines—debt, equity, M&A, venture capital, and private equity—for business growth.

Southeast Asia (SEA) has all the elements for explosive e-commerce growth: a huge population driving high consumer purchase activity, improving digital and financial inclusion metrics, and start-ups facilitating easier online consumption activity. The ongoing pandemic forcing Southeast Asian countries to implement their own quarantine protocols also furthered the growth of this sector.

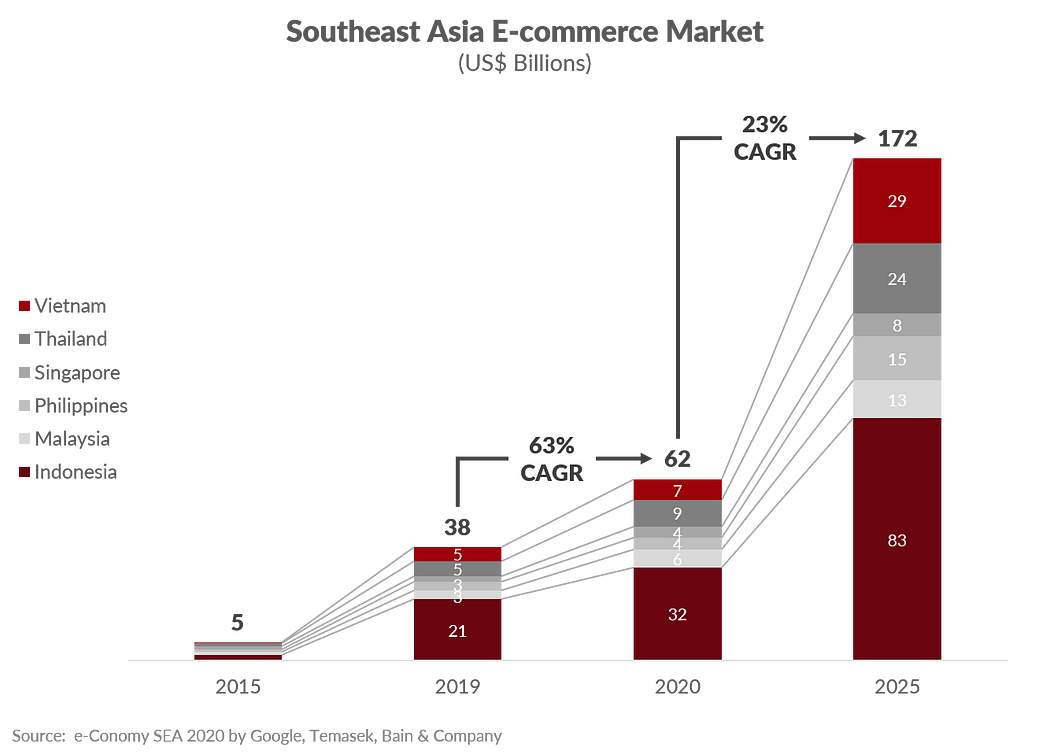

According to the most recent study of Google, Temasek, and Bain & Company, the SEA e-commerce market grew 63% from 2019 to 2020 and is seen to grow at 23% CAGR from 2020 to 2025. The top countries in the study are Indonesia, Vietnam, and Thailand.

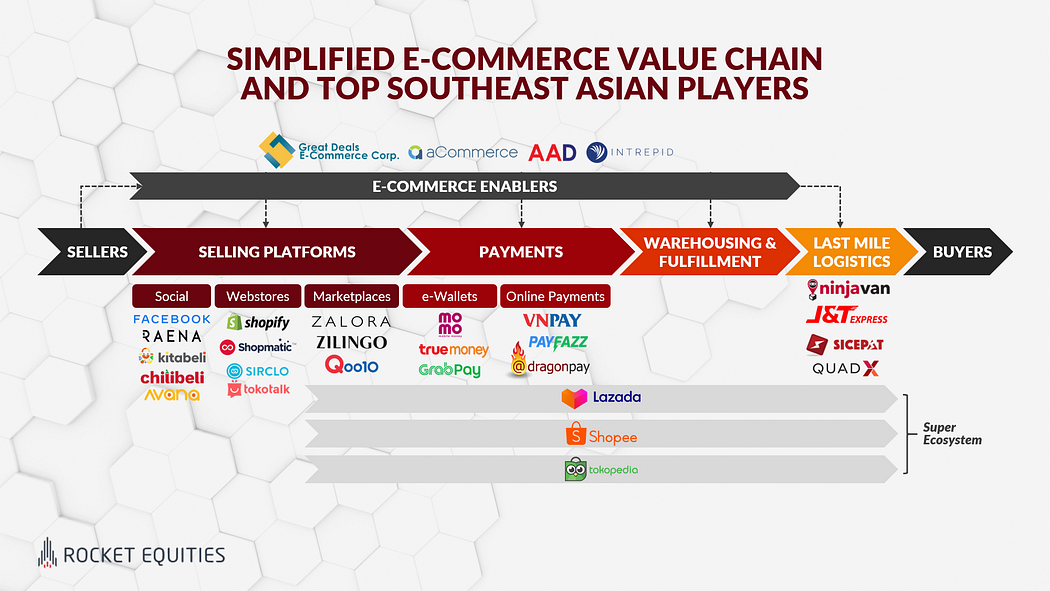

The figure above shows how the e-commerce value chain works, particularly in SEA, from the sellers down to the buyers. The sellers peddle their products through online platforms, and they need to build relationships with payment systems and logistic companies for buyers to purchase and receive their products. Warehousing and fulfillment are mostly done by either the seller or the logistics facility.

The top channel to purchase products online is still through online marketplaces. According to Web Retailer, the top online marketplaces in the region are Shopee, Lazada, and Tokopedia. The only specialized online marketplace that made the list is Zalora that sells fashion items. Web Retailer’s list also shows that the local marketplaces (e.g., Tokopedia, Bukalapak, Tiki, etc.) can also have a huge following from local consumers.

It is also important to note that Amazon is a popular e-commerce platform in SEA. This means that Southeast Asians have a substantial cross-border online shopping appetite.

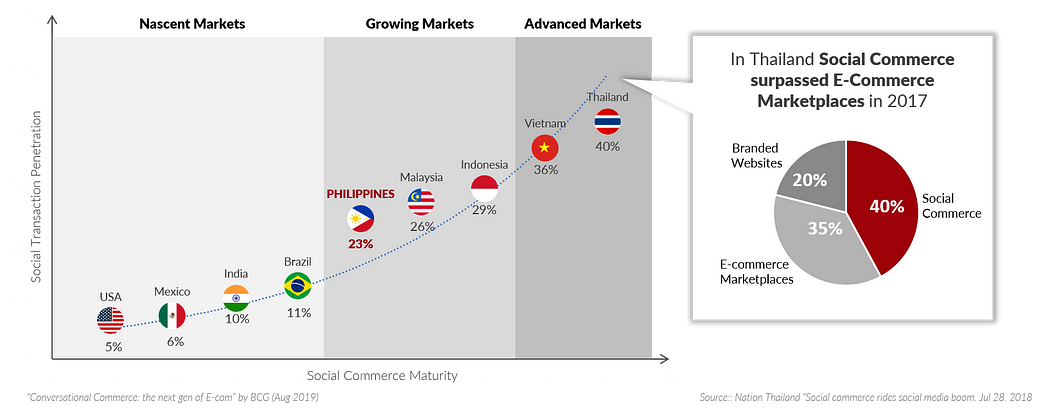

Social commerce is an emerging channel in e-commerce, and it is powerful in SEA, with Thailand, Vietnam, and Indonesia as the top markets. Social commerce delivers quick and personalized experiences that SEA consumers want. Through social commerce, consumers gain the ability to customize products, bargain, and ask for advice and clarification on products in a very efficient manner.

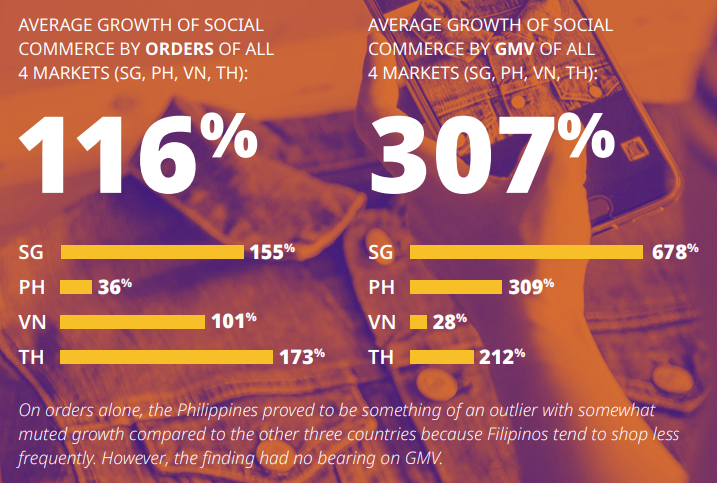

According to a study done by iKala in 2020, consumers in Southeast Asia find it quick and easy to shop via social media channels leading to growth in both the number of orders and gross merchandise value (GMV).

Social commerce is not showing any signs of slowing down that there are now startups taking advantage of this trend. KitaBeli, for example, is an app-based platform that offers group-buying solutions, and Chilibeli, an online community-based platform offering agricultural products.

Most SEA buyers and sellers communicate using Facebook channels like Messenger and Instagram. There are startups that help buyers make the shopping experience easier and more enjoyable, like AVANA. AVANA is a provider for social media store platforms that helps merchants sell directly from their Instagram and Facebook pages.

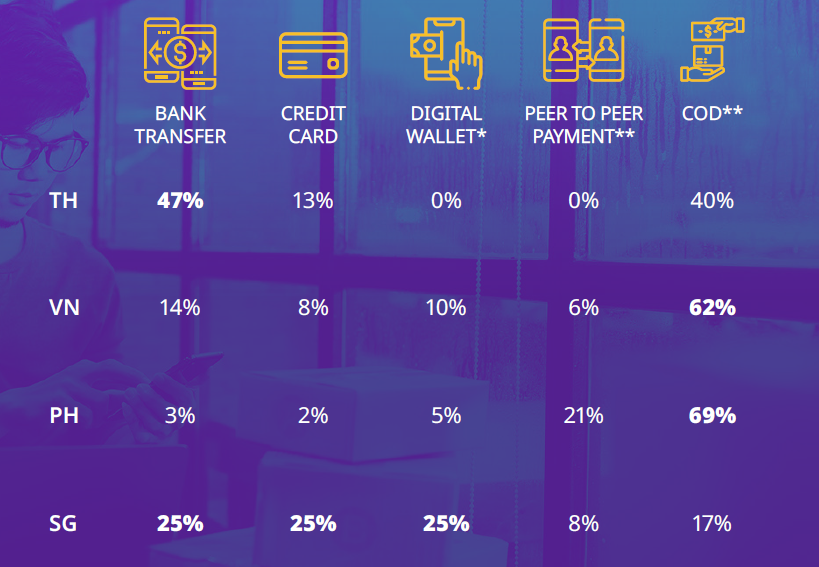

After transacting online, either through social or online commerce, the next step is paying for your purchase. In SEA, cash is still king, with most online purchases still paid via cash-on-delivery (COD). However, there is an increasing trend of SEA consumers using digital channels for their payments mostly through bank transfers and credit cards. Digital wallets are also gaining traction and are seen to be used more in the future.

The last step in the value chain is last-mile logistics, including warehousing, fulfillment, and delivery. The last-mile logistics industry is enjoying the growth of e-commerce. As more buyers are purchasing online, more parcels need to be delivered.

As shown in the value chain illustration, the winner in this industry is the logistics company with the strongest relationship with e-commerce marketplaces and platforms. Logistics companies are very dependent on the volume assigned to them by the online marketplaces. The more volume given to them by marketplaces, the more parcels they can deliver. And if less volume is given, this can result in tremendous losses for the company.

With the huge volume of online orders, marketplaces and merchants are overwhelmed. They cannot keep up with the fulfillment, online store management, customer service, marketing, and other facets of online selling. This is where e-commerce enablers step in. E-commerce enablers assist merchants and marketplaces in the online selling activity. It can be through software services (e.g., analytics, marketing) or ancillary services (e.g., fulfillment, warehousing). The value chain I had shown before showed the top enablers that provide ancillary services.

The super ecosystem is a recent trend being done by the top SEA e-commerce startups like Lazada, Shopee, and Tokopedia. These start-ups eat up and down the value chain to get more value from their consumers and improve their margins. Lazada, Shopee, and Tokopedia are doing this by creating super apps, a one-stop-shop app. Using their apps, consumers buy, pay, and track their delivery. There is no need to use other apps for payment and delivery, making online shipping very easy and efficient.

The super ecosystem created by the top SEA e-commerce brands might spell a disaster to startups down the value chain, most especially to logistics. If these three will be able to fulfill all of their online orders and process payments there will be no need for third-party companies to provide such ancillary services.

Rocket Equities, a corporate finance and M&A advisory firm for fast-growing mid-sized companies in Southeast Asia.

Latest fundraising news on E-commerce from Rocket Equities- Great Deals raises US$12M from Navegar to be the Alibaba of the Philippines.