How Healthcare Funding in the Philippines Impacts Patient Care — July 08 2025

Explore how healthcare funding in the Philippines improves patient care through better access, upgraded facilities, and stronger medical staff support.

Video Gaming is now a professionally played global sport with a valuation well above $440.8 billion in 2021.

In our previous blog, we discussed the evolution of the gaming industry and how online gaming has emerged as an extremely promising industry over the years. (See — The esports and gaming landscape Part — 1). Here, we will take a deep dive into the professional world of online gaming — a sport replete with professional players, teams, followers, and fans.

Esports with major gaming leagues and large-scale tournaments although still considered a niche when compared to other leading sports like soccer, tennis, basketball & baseball, is growing rapidly, and there’s a lot of untapped potential waiting to be harnessed.

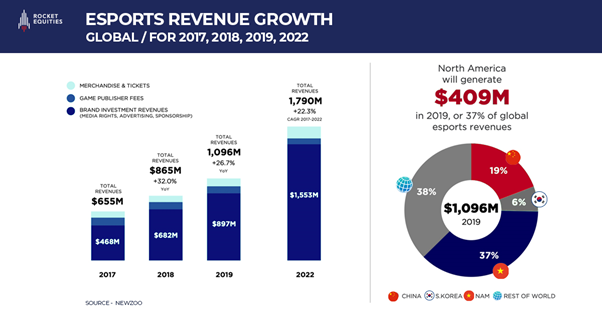

According to Sports Global Market Report 2021, the global sports industry was estimated to be valued at $440.8 billion in 2021, with a CAGR of 3.4% since 2015, and is estimated to grow at 4.9%for the next three to five years according to PwC’s 2021 Sports Survey. In comparison, the global gaming market size is estimated to be $172 billion and the esports industry is estimated to be valued at $1.08 billion in 2021, with a CAGR of 22.3% for 2017–2022 and expected to register a year-on-year growth rate that is more than three times the growth rate of the global sports industry.

According to Newzoo, USA, and Canada, both are the biggest markets in the esports industry with the revenue generated from this region in 2019 adding up to $409 million which is about 37% of the total revenue generated in the industry.

China is currently the biggest esports market in the world and this can largely be attributed to the rapid growth of the mobile esports gaming market. iResearch’s 2021 China Esports Industry Report in May 2021 states that the total market size of the country’s esports industry was 145 billion Yuan (22.5 billion USD), and this is expected to grow more than 180 billion yuan (28.3 billion USD) in the coming years.

Honor of the Kings World Championship Cup with the prize pool of a whopping $7.7 million (56% increase from 2020 — $4.6 million) was the biggest mobile esports tournament to date. Organized by Tencent and VSPN, the tournament took place in China, but due to the lockdown, only the players who had been staying in China before the lockdown were able to participate.

South Korea is a fast-growing esports powerhouse and is home to some of the best teams and top pro-league players. They have won the Riot Games’ most-watched esports tournament — League of Legends World Championship six times in the last decade.

Germany and Britain are the other countries that make it to the top 5 esports markets globally. According to Omdia (via GameDeveloper), these top five countries accounted for over 73% of the total revenue in 2020, but with larger internet adoption, increased connectivity, and improved internet capabilities — South America and Eastern Europe are the fastest growing esports markets with a CAGR of 17.7% and 16.9%, respectively. Other important regions include — Asia-Pacific, the Middle East, Western Europe, and India, with the projected CAGR being around 14–16% for all these regions.

We believe Asia is a market to watch out for as gaming and esports are growing rapidly from a niche to mass adoption in this region. Also, Esports is now included in Asian Games 2022, which will happen in Hangzhou, China, this September.

In the above figure, the complex network of the esports ecosystem has been summarized. The key players in this ecosystem are:-

Integral to the esports ecosystem are the players who spend countless hours playing video games and honing their craft to get to the top to get noticed. Players can either choose to play professionally in the competitive world or become streamers.

Professional Players have to be really good at their game and start by competing in their local and regional league to come on top and compete in the major gaming leagues on the global stage.

The few who rise to the professional level compete in tournaments all around the world against the best teams. During the journey, they usually build up a fan base for themselves as well as for the teams and organizations they play for. Successful pro gamers can earn six-figure salaries or even millions. N0tail, JerAx, and ANA are some of the leading pro-gamers.

Streamers are valued based on their popularity, and fans follow streamers not only for their skills but also for their entertainment value. A Swedish streamer on Youtube called ‘PewDiePie’ has about 111M subscribers with a net worth of $54million (as of 2021)

Teams can specialize and compete in one specific game like — League of Legends, CS-GO, or DOTA and compete in different tournaments. Getting recruited by one of the esports teams is usually the first step into professional gaming from many players. Every team has its fan-following and a gaming community that will follow their games online on streaming platforms or in-person tournaments at gaming arenas. Evil Geniuses, Team Liquid, and Fnatic are some popular esports teams.

Organizations like Cloud9, TSM, Optic Gaming, or NRG, have many professional teams that play different sports under their brands. These organizations recruit high-profile players and teams, similar to the football clubs like — Chelsea FC or Liverpool FC. They have their own revenue streams apart from prize pools which include — branded merchandise and sponsorships from brands.

Every popular video game, whether it is multi-player or 1v1, has its own gaming league and tournaments. These are played at different levels starting from regional tie-ups and tournaments to large scale — seasons, play-offs, and world championships.

Some popular league organizers include Major League Gaming (MLG), Electronic Sports League (ESL), and Riot Games.

Game developers & publishers are essential power players of the esports ecosystem. The main form of revenue generation for developers is Downloadable Content (DLC) and in-game advertisement or promotions for brands. Tournaments organizers have to pay the game publishers a license fee to use their games for their tournaments.

Riot Games, Activision Blizzard, and Carbon Games are some notable publishers.

As competitive esports events become mainstream and attract more fans, the value proposition of access to young and digital audiences increases for brands and sponsors. Hence, sponsorship is the main contributor to the monetization of the esports sector. Both endemic and non-endemic brands such as Coca-Cola, Audi, Intel, Mercedes Benz, VISA, and many other Fortune 500 companies sponsor esports events. There are multiple sponsorship opportunities such as leagues and tournaments, professional esports teams, individual players, streamers, gaming arenas, as well as affiliate marketing.

During the digital era, the emergence of streaming platforms has proved to be a catalyst in making esports popular among Gen Z & Millennials. Exclusive deals for the streaming rights of popular esports titles have been sought after by streaming platforms. Sports Business Daily reports that Twitch paid over $90 million for the streaming rights of the first two seasons of Activision Blizzard’s Overwatch League. In 2020, YouTube struck a deal with Activision Blizzard for the exclusive right to stream Overwatch League, Call of Duty League, and Hearthstone events for a total sum of $160 million. Fox Sports also has a media rights deal for FIFA’s World Cup through 2026.

Live streaming, restreaming, ticketing sales from live events, sponsorships & advertisements are common ways streaming platforms generate revenue with the big league games.

These platforms also enable players to become streamers and earn money in the process, which attracts more users to sign up on the platforms.

Fans are at the very core of the sector’s monetization strategy. 63% of the total Esports’ audience are young males, from 21–35 yrs age group, women represent 31% and are most likely from the same age group. These Gen Z and Millennials spend a material part of their time online, and this is precisely why esports is the perfect channel for brands to reach and engage with this target group.

Other than sponsorship and advertising, there are many different ways to monetize fans. Fans donate to prize pools in support of their favorite teams and players, buy tickets to live events and streams of gaming tournaments, bet on the outcome of gaming leagues and purchase customized merchandise. Currently, esports’ fans are severely under-monetized compared to fans of traditional sports, but this trend will slowly change going forward.

Rocket Equities is a Southeast Asia-focused financial advisory firm experienced in capital raising, M&A, and buy-outs.

Rocket Equities works with market leaders in tech and tech-enabled companies to raise capital in debt & equity markets, acquire competitors locally and regionally, and create an exit for founders by leveraging its network of 300+ professional investors composed of VCs, PEs, Corporates, and CVCs in APAC.

Latest fundraising news on gaming & esports from Rocket Equities — Philippines-founded esports startup Mineski Global nets $10.6 million Series A Funding