Lockdowns worldwide led schools to close and lectures to migrate online last over the last couple of years. Teachers frequently found themselves having to rethink their teaching strategies from the start to adapt to a new learning environment, such as an online classroom, without losing their students’ attention.

EdTech or “Education Technology” can be defined as improved learning through the use of a combination of IT tools and educational techniques.

There has recently been a disruptive shift in the education sector — from traditional learning to personalized and interactive methodologies. Because of innovative tactics combined with new technologies, digitization has progressively impacted education, and “learning” has now become a lifetime process. Analysts predict that the EdTech sector would thrive across geographical regions and socioeconomic backgrounds.

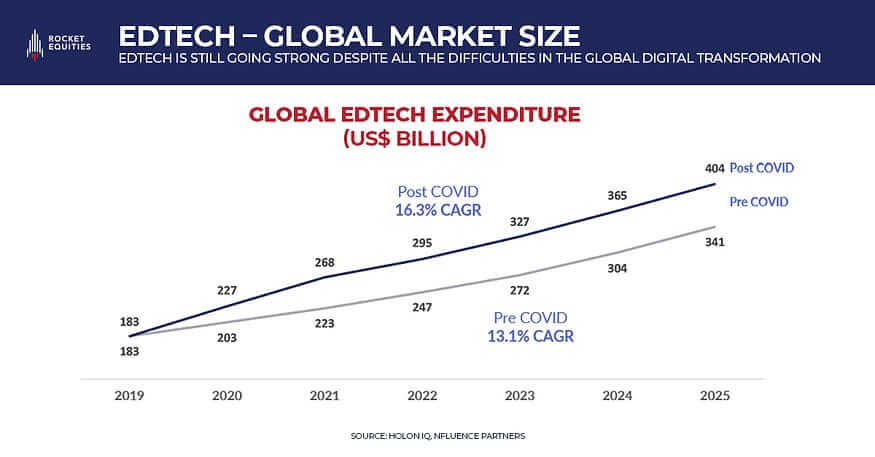

In the context of a reduction in overall worldwide expenditure, the global market size for EdTech is a US$ 63B increase above pre-COVID forecasts. According to Holon IQ, total global EdTech spending is predicted to reach $404 billion by 2025, indicating a 16.3% CAGR, or 2.5x growth, from 2019 to 2025.

Among the US$ 6.4 trillion spending on Education & Training, there is less than 4% (USS$ 268 billion) of the digital expenditure. EdTech expenditure is expected to account for 5.2% of the US$ 7.8 trillion Education & Training market in 2025.

An increase in EdTech spending caused by COVID-19 is predicted to re-calibrate to a longer-term integration of digital technology and a shift to considerably higher use of online education in the future years. As most schools and colleges are still beginning of a long digital maturity journey, a significant infrastructure catch-up is necessary for managing curriculum, data, and administration.

According to Grandview Research, North America dominated the market in 2021, accounting for more than 35% of global sales. This significant percentage can be attributed to a large number of venture capitalists and private equity investors investing in the EdTech sector in the United States.

From 2022 to 2030, Asia Pacific is expected to have the fastest CAGR of 19%. This increase can be ascribed to the increasing popularity of computing and smart-gadgets among the general public. In recent years, developing countries such as India have seen a surge in inexpensive broadband connectivity, resulting in a slew of businesses reaching out to the populace. This trend might allow consumers to experience education learning through the usage of internet connectivity. Furthermore, players in education in poor countries are increasingly considering technology to fill the void between educational infrastructure and instructional resources.

EdTech Industry can be segmented based on:

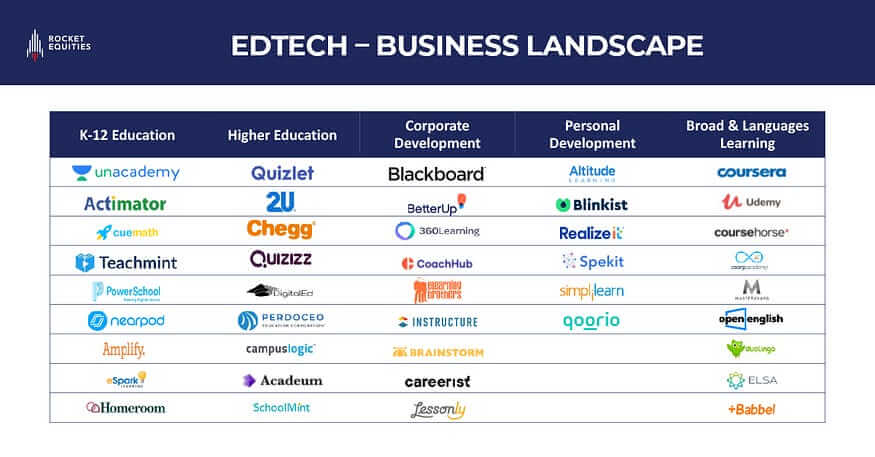

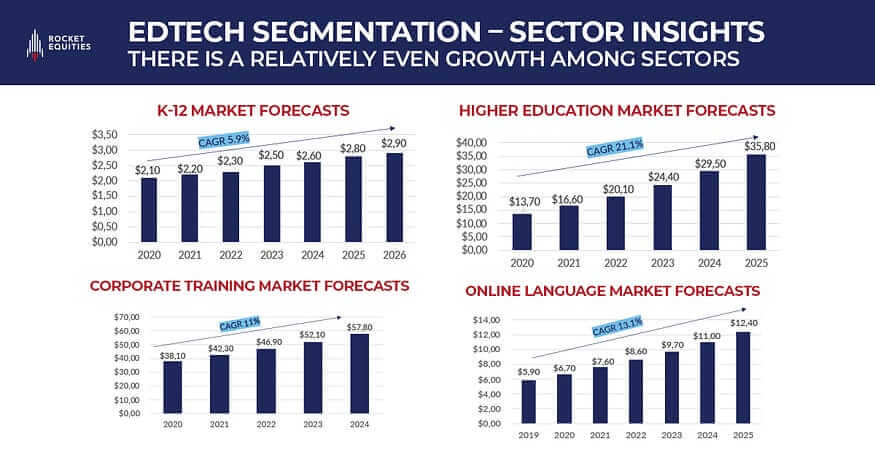

K-12 Education. Companies providing online courses, educational resources, learning platforms, management solutions, teaching resources, and other services for K-12 students, teachers, parents, and administrators

Higher Education. Companies providing online courses, educational resources, learning platforms, management solutions, teaching resources, and other services for Higher Education students, teachers, and administrators

Corporate Training. Companies offering software for creating, managing, and tracking employee training

Broad Learning. Companies providing online courses, educational resources, learning platforms, management solutions, teaching resources, and other services for diverse types of customers.

Language Learning. Companies provide platforms for students of all age groups (pre-K, K-12, Higher education, professionals) to learn various languages online.

The global EdTech landscape has taken leaps & bounds and requires businesses to adapt on-the-fly. This massive growth has led to several trends in the EdTech market in recent years.

Online platforms allow learners to interact in real-time with each other to discuss topics for team collaboration.

The accessibility of knowledge is the main advantage of these technologies for teaching across different media. These platforms foster collaborative relationships between teachers and students. They facilitate group activities and communication.

AI in EdTech facilitates personalized learning. EdTechs learn how to teach students better.

AI helps to understand the individual’s reasoning that strives to personalize lessons, readings, practice activities, and assessments for individual students based on their current skills and performance.

EdTechs links internship offers with teachers and students.

EdTechs use games to the power of games to define and support learning outcomes. These technologies make it possible to reinvent learning methods using neuroscience.

The disruptions caused by COVID-19 offered a historic opportunity to transform education systems and realize the promise of education technology. In most countries, people have adopted, rolled out, and used more of the functionality of EdTech tools. Although the world is moving to the new normal, EdTech has successfully educated the market about its benefits and value. As a result, the market is expected to have fast-paced growth with high adoption in education worldwide.

At Rocket Equities, we are committed to supporting businesses and investors navigating the evolving education technology landscape. Our expertise in capital raising and strategic advisory helps EdTech companies unlock growth opportunities and connect with leading investors across APAC. Reach out to our team to learn how we can help you achieve your goals in this dynamic sector.

Dung Nguyen Tuan

2022-09-01 • 8 min

Rocket Equities served as the exclusive financial advisor to the Philippines' leading digital rewards and incentives platform, Giftaway, Inc., in securing a US$ 18M investment from Aura Private Equity and its co-investors.

CREA, a prominent Thai e-commerce player, has been strategically acquired by OnPoint, Vietnam's leading e-commerce enabler, with advisory support from Rocket Equities.